This is a subsidy of 75% of employee wages for up to 12 weeks (Periods 1 to 3) from March 15 to June 6, 2020. This program is available to eligible employers that have seen a revenue reduction of at lease 15 percent in March and a 30 percent reduction for the remaining months.

This subsidy has been extended to August 29, 2020 (Periods 4 to 6). Subsidy calculations has not changed.

Claim Period |

Start Date |

End Date |

1 |

March 15, 2020 |

April 11, 2020 |

2 |

April 12, 2020 |

May 9, 2020 |

3 |

May 10, 2020 |

June 6, 2020 |

4 |

June 7, 2020 |

July 4, 2020 |

5 |

July 5, 2020 |

August 1, 2020 |

6 |

August 2 |

August 29, 2020 |

Please visit the following link to get more information about:

Canada Emergency Wage Subsidy (CEWS)

oWho is an eligible employer

oDetermine your eligible employees

oCalculate your subsidy amount

* Please download the latest calculation spreadsheet as you will need this in conjunction with the WinTax report information which you will enter into the spreadsheet to calculate the subsidy amounts that will be awarded to you.

oHow to apply

oAfter you apply

oContact the CRA

| * You can download the CRA spreadsheet Calculator from the web site above. |

The subsidy has again been extended to November 29, 2020 (Periods 7 to 9).

7 |

August 30, 2020 |

September 26, 2020 |

8 |

September 27, 2020 |

October 24, 2020 |

9 |

October 25, 2020 |

November 21, 2020 |

Note: Excel calculation work sheet is different from the one used for periods 1-6.

It contains an additional column ()

* You can download the CRA spreadsheet Calculator from the web site above.

•Overview

•Eligibility

•Calculating Revenues

•Eligible Employees

•Eligible Remuneration

•Calculating the wage subsidy

•Claiming the wage subsidy

Ensuring Compliance

Important things to know relating to WinTax provided reports:

Section 26-1 of FAQ: Aligning pay periods (Weekly, Bi-weekly..) with eligible renumeration

While the eligible remuneration must have been paid to the eligible employee, it does not matter whether the employee receives their pay cheque for a week at the end of the week, at the end of the month, or otherwise. If an employer’s payroll cycle does not align with the wage subsidy for the claim periods, they will have to do a manual calculation to reflect the remuneration paid in respect of that claim period. Employers will not be permitted to use an average of the daily wages paid. The eligible remuneration reported on an employer’s wage subsidy application must reflect the actual amount paid in respect of the claim period.

Section 26-2 of FAQ: Averaging daily wages

In calculating the wage subsidy for an eligible employee for a particular week in a claim period, the eligible employer takes into account amounts paid to the employee in respect of that week. If an employee’s remuneration fluctuates from day to day, for example depending on shifts and hours worked, employers will not be permitted to use an average of the daily wages paid to calculate the subsidy. In addition, an employer cannot use an average of total daily wages for all eligible employees to calculate the total subsidy for each week, as the subsidy must be determined on an employee-by-employee basis.

WinTax implementation::

CRA is only concern with wages earned on each day of the CEWS claim period, Therefore if one has the details (hours and rate) of the the wages paid on a daily basis, then one should use the information to calculate the correct amounts.

Using WinTax as an option, WinTax CEWS reports will use the 'Pay Ending Date' to slot into the correct Claim period weeks or bi-weeks. The main function of the reports is for one to use them as a working document to estimate the wages paid as correctly as possible.

Reports from WinTax 'Payroll Reports' menu:

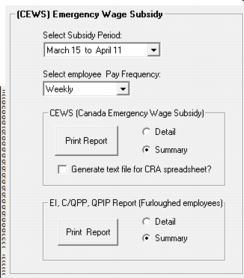

1. (CEWS) Emergency Subsidy Report

•Select the Subsidy claim period (Mar 15 - Apr 11; Apr 12 - May 9; May 10 - June 6)

•Select the Pay Frequency (Weekly; Bi-Weekly; Monthly; Semi-Monthly)

•Select the CEWS report

- Click Detail to display employees with the pay information

- Click Summary to display the total for each employee

- Check the Generate text file to create a text file (after viewing and exiting the report)

for pasting directly into the CRA's CEWS spreadsheet (weekly or Bi-Weekly Tab)

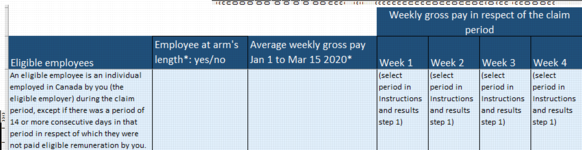

Weekly worksheet:

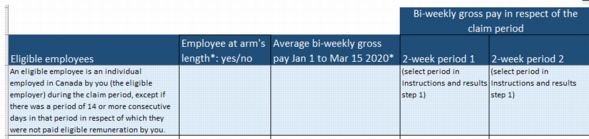

Bi-Weekly worksheet:

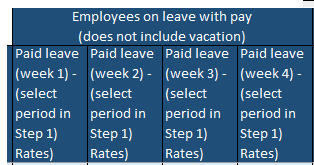

•Starting Claim period 5-6, there is an extra column of information required.

| WinTax will only insert 'Yes' or 'No' for all columns depending on your selections. |

| Individual input has to be done manually on the Excel spreadsheet. |

|

2. Employer EI, C/QPP, QPIP Contribution Rebate Report

•Select the Rebate report (only Furloughed employees are eligible for rebates)

- Click Detail to display employees with the pay details and employer contribution

- Click Summary to display the total rebates for the employer

Setting employee properties on the 'Employee' screen

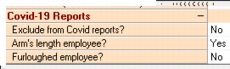

•Exclude from Covid-19 Report

- for some persons on your payroll system you do not want to include (owners, contractors etc.)

•Arm's Length employees (For some relatives of the owner or majority share holders)

- default is Yes.

•Furloughed employees (only Furloughed employees are eligible for rebates)