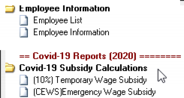

This is a temporary three-month subsidy program that will allow eligible employers to reduce the amount of payroll taxes submitted to the CRA.

This subsidy is 10% of the remuneration you pay between March 18, 2020 to June 19, 2020 up to $1,375 per eligible employee and to a maximum of $25,000 per company.

NOTE: The 10% Wage Subsidy will need to be subtracted from your CEWS submission, if you apply for both subsidies.

Reference: CRA FAQ on 10% Wage Subsidy

WinTax implementation:

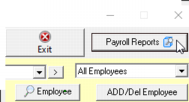

The report is located on the 'Payroll Reports' menu,

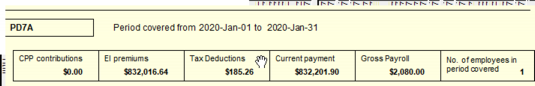

From the report, you will add all the pays that belong to your CRA Remittance period

From the CRA Remittance period report, subtract the subsidy amount from the 'Tax Deductions' amount to arrive at your Remittance 'Current Payment' total amount.